Insights

Archive

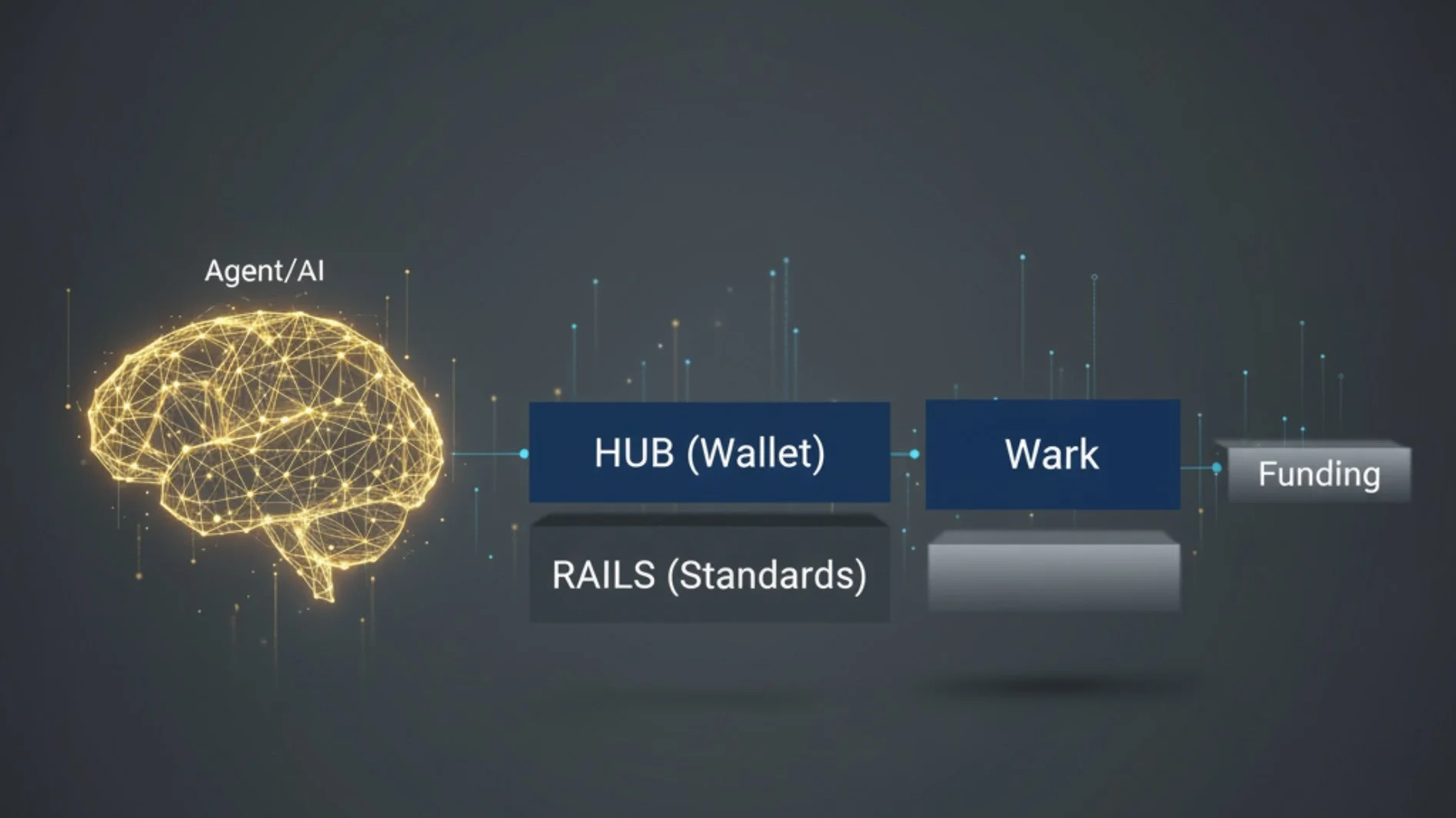

The New Commerce Stack: How AI and Payment Protocols Are Engineering Financial Institutions Out of the Customer Relationship

In 48 hours, OpenAI, PayPal, and Mastercard unveiled a new "Agentic Commerce Stack." This strategic analysis breaks down the layers and explains the existential threat of "disintermediation by protocol" to banks and credit unions.

Is Your Organizational Structure Sabotaging Your Strategy?

Most credit unions run ambitious strategic plans through outdated, monolithic organizational charts. Learn why this structure is a liability and how to redesign your organization to support both core operations and new innovation.

Reputation Risk Isn't Gone, It's Yours: A Board's Guide Post-NCUA Shift

The NCUA is removing reputation risk from exams, but that doesn't mean it's gone. Learn why managing your credit union's reputation is a critical strategic function for the board and how to integrate its oversight into your governance process.

Open Banking: Reshaping Your Credit Union's Business Model

Open banking is more than a regulation; it's reshaping the financial landscape. Explore the key threats and strategic opportunities open banking presents for your credit union's business model, revenue streams, and member relationships.

The New Normal: Why a Flat Remote Work Trend Is a Powerful Strategic Signal

New data from the Federal Reserve shows that remote and hybrid work trends have stabilized. This "plateau" is a powerful strategic signal, confirming that workplace flexibility is a durable feature of the modern talent market and a reliable competitive advantage.

The New Bottom Line: How Workplace Flexibility Became a Strategic Asset

Groundbreaking research from Harvard, Brown, and UCLA shows top talent is willing to trade significant salary for workplace flexibility. Learn how credit unions can leverage a remote or hybrid model as a strategic asset to attract talent and reinvest in member value.

Beyond the Points War: A New Playbook for Credit Union Credit Cards

Credit unions can't win by fighting the "points war" against mega-banks. Discover a new playbook for your credit card strategy that focuses on simplicity, community, and financial wellness to build genuine member loyalty.

Building the Perpetual Board: A Leader's Guide to Succession Readiness

Effective board succession is not about reactively filling seats; it's a strategic discipline. Learn a four-phase workflow for assessing your board's skills, defining future needs, and building a perpetual, future-ready board.

A Leader's Guide to Strategic Foresight & Scenario Planning

Traditional strategic planning often fails in an unpredictable world. Learn a powerful three-part process for building a resilient strategy by mapping your business model, stress-testing it with future scenarios, and focusing on what matters most.

The Manager's True Superpower: A Guide to Scientific Talent-Spotting

A recent Wall Street Journal study revealed the single most impactful trait of a great manager. Learn what it is, and how a framework like the Risk Type Compass can turn this intuitive "knack" into a reliable science for talent development.

You're Gonna Need a Bigger Boat: A Risk Analysis of the Leadership Team in "Jaws"

What can the crew of the Orca from the movie "Jaws" teach credit union leaders about risk? A deep dive into the Risk Type Compass™ reveals how the clashing personalities of Brody, Hooper, and Quint offer timeless lessons in team dynamics.

Sustainability vs. Resilience: A Board's Guide to a Future-Proof Credit Union

In the boardroom, are "sustainability" and "resilience" just buzzwords? Learn the critical difference between the two concepts and discover an actionable checklist for building a credit union that is both sustainable and resilient.

Your Credit Union's Blueprint: A Guide to the Business Model Canvas

Can you explain your credit union's entire business on a single page? Discover the Business Model Canvas, a powerful framework with nine building blocks designed to help your leadership team create strategic clarity and alignment.

What's Your Team's Risk DNA? An Introduction to the Risk Type Compass

Every leadership team has a unique "risk personality." Learn how the Risk Type Compass framework can help your credit union understand its natural approach to risk, leverage its strengths, and mitigate its strategic blind spots.

Recruiting for the Future: A Modern Approach to Board Succession Planning

Effective board succession is not about replacing individuals; it's a strategic discipline. Learn how to use a Board Skills Matrix to identify future needs, pinpoint skill gaps, and recruit the leadership your credit union needs to thrive.

The "Living System of Governance": How to Build a Proactive Board Calendar

Move your board from reactive to proactive. Discover how a "Living System of Governance," powered by a proactive board calendar, can transform your board's effectiveness, ensure compliance, and generate a perfect audit trail.

Is Your Board a Strategic Asset or a Compliance Backstop?

Is your board's primary focus on compliance, or is it a true partner in shaping strategy? Explore the difference between a reactive "compliance backstop" board and a proactive "strategic asset" board, and why the distinction is critical for your credit union's future.

Beyond the Score: How to Use Peer Benchmarking for a Competitive Advantage

A performance score in isolation tells only half the story. Learn how to use peer benchmarking not just for reporting, but as a proactive tool to identify hidden strengths, uncover strategic vulnerabilities, and gain a real competitive advantage.

What's Your Number? The Power of a Single Health Score for Strategic Oversight

Just as a FICO score distills a complex credit history, a single health score can bring clarity to your credit union's performance. Discover why a unified, validated metric is an essential tool for effective board oversight and strategic decision-making.

Drowning in Data, Starving for Insight: The Credit Union Leader's Dilemma

Many credit union leaders are drowning in data but starving for insight. Learn why more data isn't always better and how a single, holistic measure of health can transform board-level conversations and drive clearer decisions.